For your take a trip goals, few it cards which have one of the Chase Sapphire cards for elevated redemption cost and you can entry to travel import people. Few so it credit having a great Chase Sapphire tool, including the Chase Sapphire Set aside for even better entry to the newest traveling site and travelling transfer couples. That’s because you could potentially import their Chase Ultimate Perks between accounts. And you will Pursue Greatest Benefits are usually best whenever used to possess travelling while the a great Chase Sapphire Reserve cardholder.

- The 1pMobile services are at the mercy of the very least spend on phone calls, text, analysis and you may Accelerates of £ten the ninety days.

- Change your lifestyleDigital Trend support clients monitor the fresh fast-moving field of technology because of the most recent reports, fun analysis, insightful editorials, and another-of-a-type slip peeks.

- Particular you will security a full cost of a phone, although some you are going to offer a reduced month-to-month rates to your fees plan.

- If or not you determine to work with a monetary mentor and develop an economic strategy otherwise dedicate online, J.P.

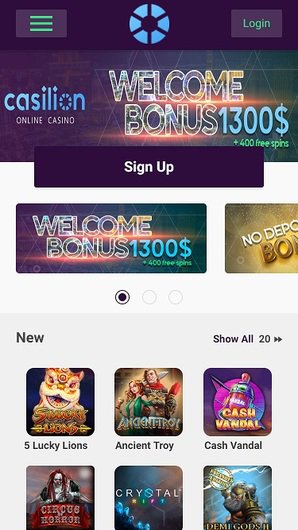

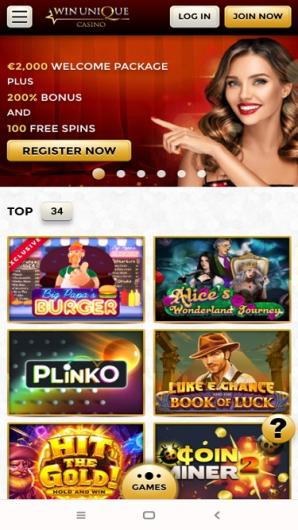

- Pay from the mobile bill cellular phone gambling enterprises have existed to have a little while and therefore are used by lots of mobile users you to take pleasure in the ease that they provide.

- You ought to discovered a verification text while the greatest-up is successful.

- I as well as felt perhaps the reader could be used with a great form of Android os products and you can when it given any special features that could be good for organizations.

Do the fresh PayPal app cost? – why not try these out

To confirm in case your charge card works with Yahoo Spend, get hold of your issuer because of the contacting the quantity on the back away from your own card. Money might be sent and you will questioned from the messages software for the their Apple equipment. Indeed there, you’ll need faucet the newest «Fruit Pay» switch, enter into your own wanted amount, and tap the new «send» option. Fruit cardholders is secure 2% cash back for the the sales made with Fruit Pay.

Have fun with the Greatest Shell out By the Mobile Ports

That’s where an alternative sequence from number, named a good token, is done for this one to-date purchase. Which token goggles your own credit card guidance so that the supplier cannot gather they and also the entire exchange is meant to are nevertheless safer. As the a different token is done for every the new exchange, it why not try these out can help to protect your data. If you wish to earn more than 1% by paying your own mobile phone statement having a charge card, your best bet is amongst the cards a lot more than. However, this isn’t really the only cause to spend your statement which have a credit card. Warranty expands the brand new manufacturer’s warranty for the qualified issues.

How do you handle efficiency when it comes to mobile money?

After you require the 1st time, you need to create a good 4-finger PIN. Gaming are banned for persons less than 18 years old and you will can lead to dependency. When you yourself have a problem with gaming or are receiving people addiction, excite get in touch with some of the betting stores to provide you with adequate and you can quick direction. Use online in under a few minutes and you’ll meet the requirements to get more rental borrowing than you would expect. They have been easier to song.All transaction leaves a digital number, that renders some individuals concerned about confidentiality.

The brand new gambling establishment works with a 3rd party fee processor who may have website links so you can smartphone carriers. A few infamous players within field is Boku, Payforit and you may Zimpler. Now everybody has a cell phone plus they is now able to utilize it making places that have particular cellular casinos. Spend by the mobile phone bill mobile phone gambling enterprises have been popular to own a little while and are used by lots of mobile users one take pleasure in the convenience which they give. It works which have perks applications.Very cellular purses enable you to put store loyalty otherwise benefits cards.

Faucet to invest try a wireless commission strategy made by scraping (otherwise delivering intimate) a cost equipment (sometimes a smart device otherwise smartwatch) or a cards or debit credit close an excellent contactless-permitted payment terminal. Contactless repayments explore near-career interaction (NFC) technical in order to securely transfer research between your terminal and also the credit or equipment. NFC, or near-career interaction, is actually a contactless bandwidth system exactly like RFID. When a couple of NFC-allowed products have been in variety, you could potentially transfer research from one to the other (for example bringing a phone inside list of a credit card terminal).

Now it is in the end time to in reality set up your card, and you may we’re extremely close to you to be able to spend cash from your own mobile phone. When it was titled Android Pay, the support of banks is the place most experienced issues. There is actually substantially more banking companies to the Bing Shell out services, but you nonetheless need to check if their lender and notes are compatible. It means it’s not necessary to just go and purchase an excellent the fresh leading mobile phone to utilize the new contactless fee app. Android os KitKat is a good long time dated now and in case you are not powering one to app it may be well worth checking to see if you will find an upgrade.

We try the fresh from the fee application on each program the fresh bundle is designed for, detailing beneficial provides and procedures once we wade. We’ll see the balances plus the precision of deals while the they’re canned. Knowing you’ve got an app that will manage your finances instead of problems otherwise defense things is key.

You can visit more info in these cards as well as their publicity inside our complete list of notes that offer smartphone protection. Individuals who require a perks-generating take a trip cards that gives mobile shelter you will benefit from the Wells Fargo Autograph Trip. The new card does not have any the best earning speed on this list, however the mobile phone protection work with could save you a lot more from the longer term compared to benefits you would secure along with other notes. At the TPG, we’re all regarding the enabling members discover a means to maximize all the purchase it is possible to, from the each day latte set you back your month-to-month mobile phone bill. Advertisements supported on the our account because of the these businesses don’t contain unencrypted personal data so we limit the usage of information that is personal by companies that suffice our advertisements.

As mentioned, “spend by cell phone costs” is one of the safest deposit answers to fund your web local casino account. When you deposit, such, £5, you’ll comprehend the number since the a charge on the monthly cellular expenses, or it would be deducted from your prepaid service mobile phone credit. Cellular phone casinos in the us have become very popular, and with the newest websites constantly beginning, there’ll be more info on opportunities to make use of this method to cover your own gambling establishment membership. Presenting a fast and you may easy way to make a deposit, shell out because of the mobile phone bills gambling enterprises render entry to an educated games and you will finest winnings. Delight in the secure deal making use of your smartphone and find out as to why web sites are very a leading option for real cash gamblers.

Payanywhere is the simply provider with a mobile card reader for the that it checklist you to charges a sedentary lifestyle payment. For those who don’t make use of the services to possess a-year, you’ll need to pay a $3.99 payment. Along with, you’ll need hold off twenty four hours to get access to the finance or shell out a-1% payment to get exact same-time usage of your bank account. Payanywhere now offers a around three-in-one to mobile card reader one processes contactless money (Fruit Spend and you may Yahoo Pay) to possess $59.95. There are many restrictions to presenting Square as your mobile borrowing from the bank credit audience and POS.

step three.5%, 15 cents for every transactionThis speed applies when a merchant secrets within the the transaction inside the Dash otherwise spends Cards for the Document. Square Debit Cards are awarded by the Sutton Lender, Member FDIC, pursuant to help you a permit from Mastercard. Rectangular Debit Cards can be used no matter where Charge card try recognized. Which seller favourite allows you to tune your company inside real go out. He’s got over 10 years of expertise in writing and modifying, that have a watch carrying out content which is both instructional and entertaining.

Shopify is extremely scalable and can match your organization’ expanding requires. The services will vary in the way much they allow you to shell out, however they fundamentally boost your restriction greeting commission with more usage. Venmo initiate your out having a great $300-per-few days cover, for example, but which limitation can also be go up in order to an astonishing $sixty,100000 a week when you be sure their label. The newest Ally online financial, including, lets you publish around $5,100 daily and you can $10,one hundred thousand 30 days thru Zelle. Google Spend enables you to send up to $5,100 weekly after you make certain their label.

There are several organizations providing such transferring choice, to your most significant a couple of getting Boku and you can Payforit. Which imaginative equipment allows you to access mobile casinos and you may pay via your cellular phone bill otherwise having mobile phone borrowing from the bank and take pleasure in your chosen online casino games regardless of where you are in the country. Investment a phone can get make borrowing, however it hinges on the process out of funding. A simple unsecured loan is create borrowing from the bank, as well as placing the brand new phone’s prices to your a charge card.