- Remark Your credit history to own Problems: Make sure your credit history is free of charge off problems. Problems can unfairly reduce your score and you can perception the loan rates.

- See Your financial Record: Lenders look at your financial history, including your credit card debt, installment designs, a good expense, and income balances. A powerful financial history is put you for the a much better updates to negotiate lower cost.

Keeping a good credit score and a robust credit history is crucial not just getting protecting a property collateral financing but for any monetary credit. Normal track of fico scores and responsible monetary conduct private loans can be rather improve your likelihood of providing favourable financing terms and conditions.

On following sections, we are going to explore tips effectively research and you can examine home equity money, lenders and you can what the current mediocre interest levels appear to be having home collateral fund. Securing the new ideal household equity financing costs involves a loans Fox AK combination of private economic health and sector good sense, thus getting informed and you can hands-on is vital.

Contrasting and you can Evaluating Loan providers

Finding the best household guarantee financing cost demands comprehensive search and review of several lenders. This action is essential given that additional loan providers render differing pricing, charges, and even installment conditions. Here is how to approach it:

- Start by Your current Bank: Take a look at just what cost and you can terms your current bank or financial supplier also provides. Possibly, existing matchmaking can result in finest business.

- Grow your Look: See other financial institutions, borrowing unions, an internet-based loan providers. For each could have additional standards and you will special deals.

- Contrast Loan Keeps: Besides the interest, thought almost every other loan has actually eg fees, installment independence, and you will customer support.

- Look at the Terms and conditions: Look out for people undetectable will set you back or clauses which will connect with your in the long term.

Think about, it is not only about picking out the amount borrowed and you will lower attract rate plus protecting financing that fits your general monetary demands. To own a detailed book about how to navigate this step, you can read more and more how to get property guarantee mortgage.

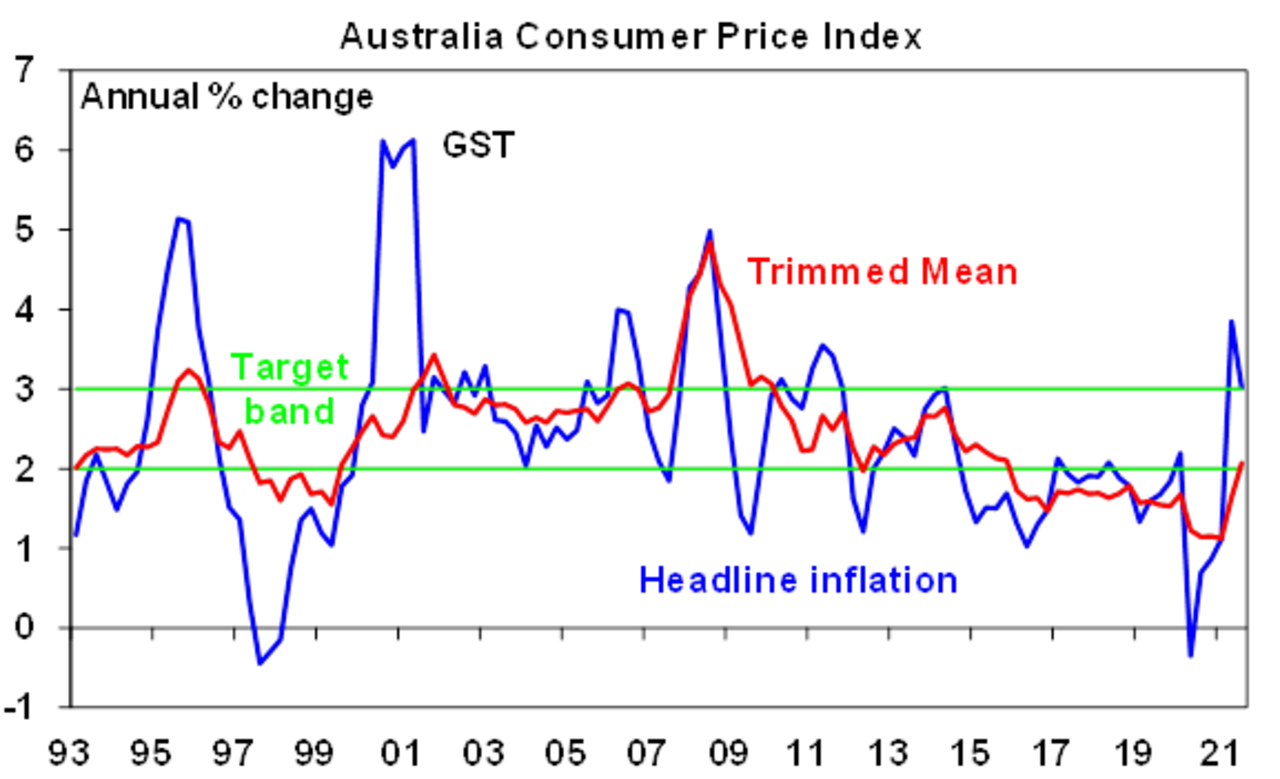

At the time of the modern markets, this type of prices was at the mercy of alter in accordance with the collection of credit and you can macroeconomic trend instance inflation costs, housing industry standards, and you can shifts inside the economic coverage

The common rates of interest for domestic security funds can differ, influenced by a variety of affairs for instance the wider monetary ecosystem, central lender policies, therefore the competitive surroundings off loan providers. Borrowers need understand that these pricing vary over time, and you may what can be the prevailing price now you can expect to move in the the near future.

These rates of interest as well as differ according to if they try repaired otherwise variable. Repaired rates of interest give you the advantageous asset of consistent monthly installments more the life of your own loan, bringing balance and predictability inside budgeting payment. Additionally, variable costs, when you are probably lower very first, can alter over the years prior to field conditions. This is why you might start with down costs opposed to a predetermined speed, you will find a possibility that your particular repayments you are going to rise in the long term.

For these seeking the most up to date and more information towards the domestic security financing pricing, you may want to see certified financial reports present. Other sites such as Reuters not just provide up-to-date information about most recent rates in addition to provide understanding towards the sector style and you will predicts. This article will likely be priceless in aiding your safer property collateral mortgage you to aligns with your financial requires while the newest economic climate. Expertise such facts and how they effect family security loan financial prices usually top make it possible for you to definitely make an informed decision into an informed household equity mortgage option for your position.